Manager rounding is the process of visiting patients and families. It affords surgery center leadership an opportunity to monitor progress, provide education, and identify areas for improvement. While rounding benefits an ASC’s leadership team and facility personnel, the most important byproduct is the impact it can have on patients and their families. There are a number of ways to maximize those benefits and achieve short- and long-term improvements in a surgery center. Here are some helpful steps to consider.

1. Be consistent.

Perform rounds every day, without fail. The goal is to round multiple times a day, and do so in a purposeful, productive manner. This may sound cliché, but it’s the only way to develop an effective process.

Maintaining this consistency requires planning. Consider in advance how you will perform rounding, when you will do it, and the way you will evaluate the information you pick up along the way.

Be consistent with where you go. Most rounding occurs in the center’s lobby, but it is worthwhile to add the pre-op area to your walkthrough. This isn’t something most administrators do. But you might be surprised how much you can learn from a quick visit to patients before their procedure.

2. Keep it a management responsibility.

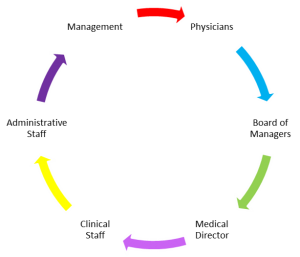

Rounding is best performed by an ASC’s managers. They’re in an optimal position to represent the facility then take what they learn and turn it into actionable information.

The task should not be delegated to staff even if management is busy. It is up to other members of the facility’s leadership team to step up if a round cannot be completed by the manager who was originally assigned the task.

3. Educate on processes.

Effective rounding is not improvised. Education is vital and may need to be tailored to each individual. Some types of education to consider follow:

- What to say to start conversations

- What questions to ask (i.e., a script)

- How to respond to different comments and questions from family members and patients

- How to approach strangers and speak with them (and do so confidently)

- How to read people

- How to document what is learned (see #4 below)

- When to elevate an issue and involve other managers or physicians

The goal with rounding is to move through the lobby or pre-op, meet people, make connections, gain information, provide information, and move onto the next person. Upfront and ongoing education will help make rounding an efficient and productive process.

4. Make the documentation easy.

The quality of the documentation can make rounding a success or failure. To achieve the former, develop a standardized form those conducting rounds can fill out quickly and legibly. Include the specific questions you are likely to ask and spaces for notes.

Also, include a checklist of topics on which you are likely to receive feedback. Topics could include wait times, requests for information, communication, and case delays. Again, leave spaces for notes.

5. Use what you learn.

What you ultimately do with the feedback gleaned during rounding is as important as the rounding itself. Establish processes for how feedback will be presented in meetings, how to determine what to focus on, and how changes or issues will be addressed. Develop an organized way for your team to consider any problems you discovered, figure out solutions, and disseminate information to staff.

The benefits of rounding may not be noticeable immediately. It’s not a process you can conduct for a day or week and expect significant changes. It may take a few business weeks of consistent rounding to deliver results.

6. Hold your team accountable.

There is a reason the first step highlighted above is the need for consistency. If a round is skipped one day and there is no ramification, soon there will be a day where two rounds are skipped. Then three. When this occurs, rounding will start to feel optional. Managers, with their very busy schedules, may find other pressing tasks to fill the time once allocated for rounds.

That’s why it is not only important to plan who will perform rounds and when, but also ensure anyone who does not perform an assigned round is held accountable.

7. Give rewards and recognition.

Rounding is intended to help bring about improvements. When improvements are made, rewarding and recognizing team members who made them happen can be an effective way to bring attention to the ongoing importance and value of rounding.

Rewards and recognition can occur when a rounding manager connects with a patient or family member and receives a great suggestion or a staff member takes on greater responsibility to help implement a change. Rewards can take the form of small gift cards or entries into drawings for more valuable gift cards. Recognition may take the form of singling out specific team members for praise at staff meetings.

8. Focus on engagement.

If a rounding program is the passion project of a single manager, it is doomed to fail. Rounding must be ingrained in all managers and staff as a critical component of your ASC’s operations. Your team must believe in its purpose and not merely view rounding as yet another task to complete.

In the early stages of a rounding program, emphasize the objectives of rounding: to bring about operational improvements that will make everyone’s job easier and better while making sure patients and their families are safe and comfortable. When managers are enthusiastic about performing rounds and staff are eagerly awaiting new feedback to drive improvements, you will know your rounding program has established a strong foundation for success.

Jebby Mathew – Director of Operations